Unlocking Profits Discover the Best Forex Trading Signals

If you are serious about trading in the Forex market, you know that having a solid strategy is crucial. One of the best ways to enhance your trading strategy is by utilizing best forex trading signals trading-fxbroker.com which provides invaluable resources, including the best Forex trading signals. In this article, we will explore what Forex trading signals are, why they matter, and how to find the best ones available in the marketplace.

What are Forex Trading Signals?

Forex trading signals are trade recommendations generated by experienced traders or automated systems based on a wide range of factors, including chart analysis, technical indicators, and economic news. These signals indicate when to buy or sell a currency pair, helping traders make informed decisions to capitalize on market movements.

Types of Forex Trading Signals

There are several types of Forex trading signals, including:

- Technical Signals: Generated using technical analysis tools such as charts and indicators like MACD, RSI, and moving averages.

- Fundamental Signals: Based on economic data, news events, and geopolitical developments that can affect currency prices.

- Sentiment Signals: Derived from market sentiment indicators that gauge how traders feel about a particular currency pair.

- Automated Signals: Generated by algorithms and trading bots that analyze market conditions and execute trades automatically.

Why Use Forex Trading Signals?

Using Forex trading signals can be extremely beneficial for both new and experienced traders. Here are some of the key advantages:

- Time-Saving: Forex signals save time, as traders don’t need to conduct exhaustive analyses of their own. They can rely on the insights of others who have already done the work.

- Increased Profit Potential: By following proven signals, traders can improve their chances of making profitable trades, as these signals are often based on comprehensive research and extensive experience.

- Learning Opportunity: New traders can learn from signals, understanding how experienced traders analyze the market and make decisions.

- Enhanced Risk Management: Many signal providers also include risk management guidelines, helping traders understand not only when to enter a trade but also when to exit to minimize losses.

Finding the Best Forex Trading Signals

With the growth of the Forex industry, numerous sources now provide trading signals. However, not all signals are created equal. Here are some tips to help you identify the best Forex trading signals:

1. Reputation

Look for providers with a strong reputation. Check reviews, testimonials, and credibility in the trading community. Reliable signal providers often have a track record of performance that you can review.

2. Transparency

Good signal providers are transparent about their methods and results. They should provide historical performance data so you can assess the accuracy of their signals.

3. Flexibility

Choose a signal service that offers flexibility in terms of trading styles. Whether you prefer scalping, day trading, or swing trading, it’s essential to find a service that aligns with your strategy.

4. Risk Management Strategies

A reputable signal provider will incorporate risk management strategies along with their trading signals. This shows that they are not just focused on profits but also on protecting traders from significant losses.

5. Trial Period

Many signal providers offer a trial period. This allows you to test the signals without making a full commitment, helping you determine if the service meets your needs.

The Role of Technology in Forex Signals

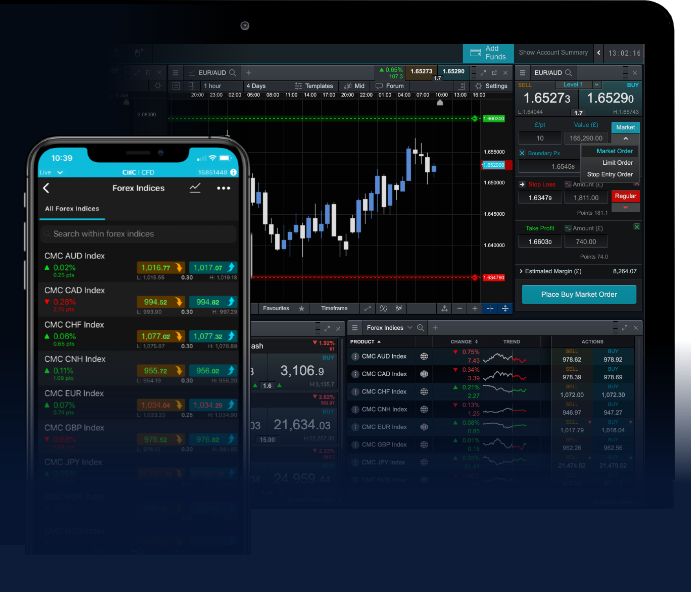

As technology continues to evolve, the Forex market has become increasingly reliant on automated systems and algorithms. Many traders now use software that integrates trading signals into their platforms, making it easier to execute trades based on real-time information.

Algorithms can analyze vast amounts of market data and execute trades quicker than a human can, providing an advantage in a fast-paced environment. This shift towards automated trading systems has heightened the necessity for traders to stay informed about the best Forex trading signals available.

Top Providers of Forex Trading Signals

Now that we have established what Forex trading signals are and how to identify the best ones, let’s look at some of the top providers in the industry:

1. ForexSignals.com

ForexSignals.com offers a comprehensive range of services, including live trading rooms, educational content, and high-quality signal alerts. Their focus on community makes them stand out in the industry.

2. DailyForex

DailyForex provides a mix of technical and fundamental analysis, along with real-time Forex signals. Their service is backed by experienced analysts and includes performance tracking.

3. 1000pip Builder

This provider is known for its transparency and detailed performance reports. They offer notifications via email and SMS, making it easy to stay updated on the latest trades.

4. eToro

eToro is a social trading platform that allows users to follow successful traders and copy their trades. This innovative model provides a unique way to access Forex signals through community engagement.

Conclusion

Forex trading signals offer valuable insights and execution strategies for traders looking to enhance their trading performance. By understanding the different types of signals, their benefits, and key factors in selecting a provider, traders can make informed decisions that align with their goals. As you explore the world of Forex signals, remember the importance of combining these tools with your analysis and risk management strategies, ultimately paving the way for a successful trading journey.

In summary, the best Forex trading signals can significantly enhance your trading strategy if utilized properly. The right provider, backed by technology and sound analysis, can be your ticket to success in the dynamic world of Forex trading.